Economic fluctuations got you worried? Read this 👇

The time to invest in growth is now, and here's why

According to Axios, “More than half of Americans — 56% — mistakenly believe the U.S. is currently in a recession.”1

And Axios isn’t the only one saying it. The Wall Street Journal also echoed the sentiment (although added that it will still feel like one since inflation).

In order for a true recession to occur, economic activity of a nation must be in decline. For the United States, this isn’t the case as GDP and the S&P 500 steadily grow.

Perhaps it’s all a media ploy to prepare us for the pending election season. There’s also a possibility that what economists are saying is true.

But regardless of what economists think and what the media says about it, American customers still likely believe that we’re in a recession — which is an important distinction.

Therefore, we should all prepare accordingly.

How to think about recessions for SaaS

If you’re targeting North Americans in any way as part of your GTM strategy, it’s important to consider how these customers and buyers think about their resources.

You see, when a recession or economic downturn of any kind happens, it directly impacts how your go-to-market functions. Customers, after all, are a critical part of GTM.

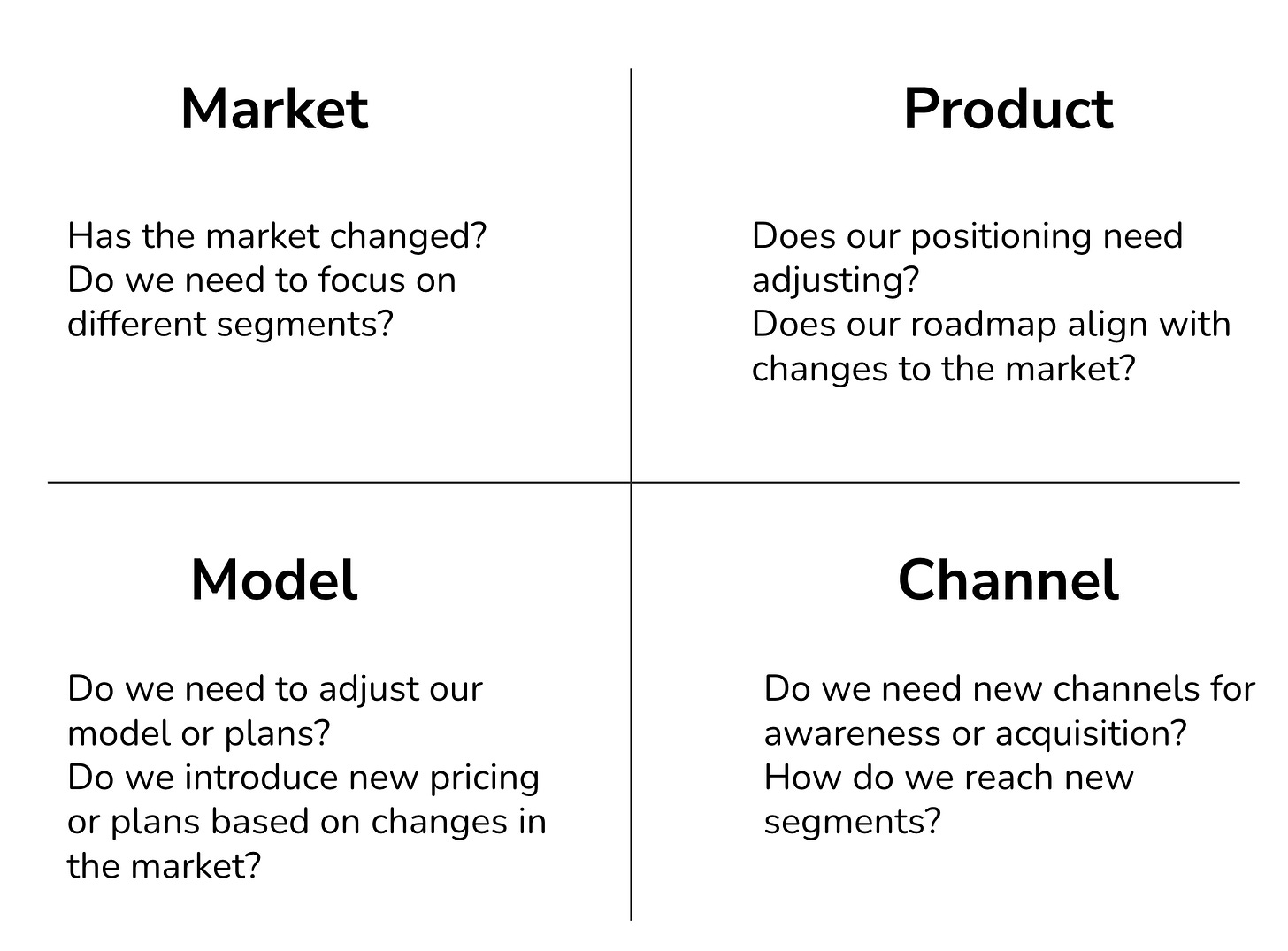

I’m bringing out one of my all-time favorite frameworks to help me break this down, and that’s Brian Balfour’s Four Fits to $100M (pictured below). I typically use this to quickly illustrate go-to-market for founders and growth leaders.

Using this simple graph, we can create a shared language for the decisions they make in their business and how it impacts how all of these moving parts together:

Downturns and recessions directly impact the Market portion of this chart first since recessions change a population’s access to capital and excess resources.

Said simply: when customers have less pocket change, they don’t buy as much stuff. When they do buy stuff, it’s with careful scrutiny.

When times are abundant, customers’ pockets are also abundant, and there’s less perceived risk with making purchases.

As your Market gets impacted by a downturn or recession, the business has a few options:

Pivot to a new market segment

For example, focus on segments that have more resources and cash to spend on services, software, etc. This could be as obvious as pivoting to enterprise companies or as subtle as focusing on more established businesses or buyers

Change the Model

Since Model includes pricing and monetization, we can decrease prices, adjust plans to accommodate price sensitive buyer segments, and more

Re-evaluate the Product with a new lens

For example, does the product need repositioning now that customers view it differently? Or perhaps there are features more aligned with customers’ needs and preserve precious resources?

Adjust existing acquisition Channels

Channels are how we acquire and source customers, and you may find that we need to evaluate how we invest in these channels to preserve profitability

What I love about this framework, though, is not just how Brian Balfour’s illustrates these four parts of go-to-market (it’s simple, easy to understand, etc.), but also because when one of these quadrants changes, all of the others get impacted in some way.

For example, if we change our core Market focus to target B2B SaaS enterprise companies, then we likely need to adjust our Model, introduce some new Channels to acquire them, and make sure our Product creates clear value for that segment.

Similarly, if we decide to add a bunch of new features to our Product (or launch an entirely new product), we need to figure out our Market, Model, and Channels if we have a hope of it being successful.

This is important in the context of a downturn because it means our Market is impacted and therefore the context of our Product changes (along with Model and potentially Channels).

The good news about all of this, though, is that unless you target consumers, you don’t have much to worry about (at least, at first).

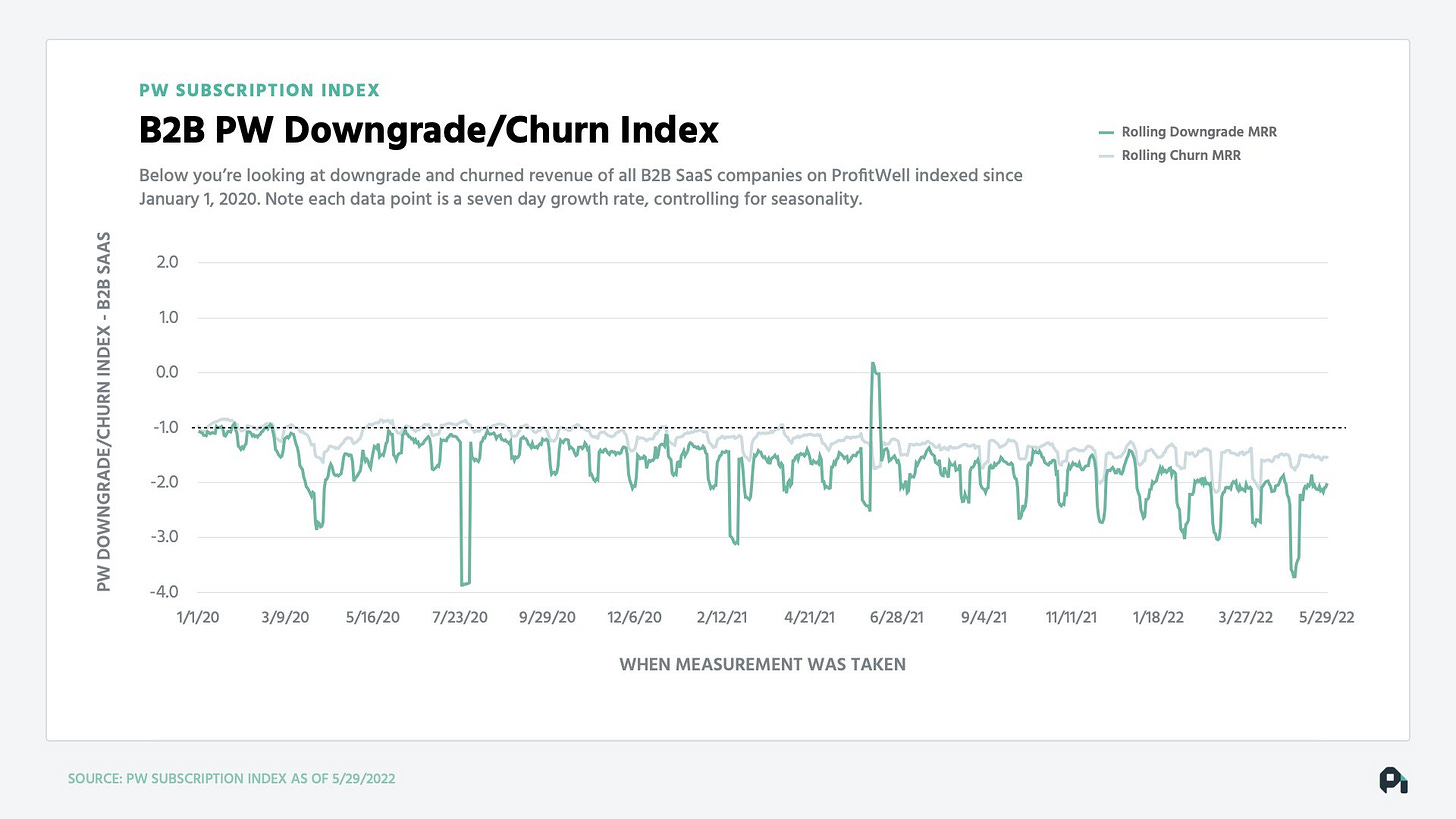

When ProfitWell analyzed the data of 22,000 software companies and looked at the B2B SaaS segment, he found that the churn index steadily worsened over time.

That, and growth for B2B SaaS also slowed down from 2020 to 2022 with B2C companies hit the hardest.

This is why consumers believing we’re in a recession — even if we’re not — is still important. We almost still have to act like we are (even though we may not be).

It’s … meta.. and the irony of that isn’t lost on me.

What the big-brains say about recessions

This brings me to all of the research and data about how businesses create opportunity even in the face of a recession.

Recessions and downturns are interesting, though, because the most resilient organizations do a zig when everyone else is zagging.

The first reaction businesses have to recessions is to cut costs (a wise and often necessary move).

I think the difference between everyone and the thriving businesses is they’re actively looking for growth opportunities rather than focusing only on reductions.

In a 2002 McKinsey & Company study Learning to Love Recessions, the resounding takeaway was:

While most companies tightened their belts, successful leaders, trading lower short-term profitability for long-term gain, refocused rather than cut spending.

Specifically, the successful companies spent significantly more on selling, general and administrative (SG&A) costs (which include marketing) than those that lost market share. In fact, the study found that successful companies spent more money (as a percentage of sales) on marketing during the recession and less during periods of growth.

Bain & Co had a similar takeaway where they found organizations that focused on growth during a recession saw 3x more growth over others who did not focus on growth.2

Bain & Co also explained in the whitepaper that “recessions are a lot like the sharp curve of a racetrack.” The best drivers do the following to beat their opponents:

Apply the brakes before the curve (cut costs)

Turn hard towards the apex of the curve (adjust the strategy and plan)

Accelerate hard out of the curve (go ham before markets rebound)

Finally, the Harvard Business Review shows us the four different strategies for handling a recession based on the analysis of 4,700 public companies coming out of the 2008 financial crisis:3

Prevention-focused companies, which make primarily defensive moves and are more concerned than their rivals with avoiding losses and minimizing downside risks.

Promotion-focused companies, which invest more in offensive moves that provide upside benefits than their peers do.

Pragmatic companies, which combine defensive and offensive moves.

Progressive companies, which deploy the optimal combination of defense and offense.

How recessions create opportunity for software companies

Don’t just take it from the academics and navel-gazers, though. I think there’s a lot of practical advice here based on everything I’ve read, consumed, and observed within my own client projects.

According to Dharmesh Shah, CTO and Co-founder of Hubspot, market downturns create three specific opportunities for startups (and even more specifically — bootstrappers):

Competitors step back from certain markets, creating opportunity for smaller SaaS companies to step in

Channels get cheaper as competitors withdraw marketing spend

Get access to talent that you otherwise wouldn’t have had access to

So if you’re anxiously biting your nails about how your SaaS will fare, fear not. Opportunities are still abundant.

Beyond that, conventional wisdom says to the focus on the fundamentals that make SaaS companies grow barring all other events and natural forces:

Acquisition

Cut the most expensive channels if cash-flow is a concern for you.

Adjust your market focus to prioritize the most profitable, lucrative customers with the highest LTVs and revenue potential. If you’re unsure of this, then you may need to consider some form of a growth audit.

“Qualify” prospects so you know if the trialists and signups are in your ideal target market(s). If you notice drops in acquisition for specific segments of qualified lead, then you know something’s up and you may need to do some troubleshooting of growth.

Activation

If you’re a product-led growth company, ensure your activation experiences are designed to convert trialists into paying customers and get them active. Ideally you have a 20%+ free trial to paid conversion rate and at least 3% freemium to paying conversion rate. Otherwise, you’re leaving free money on the table.

If you’re sales-led, optimize your onboarding process to ensure customers are able to get active and get to their value moments as fast as humanly possible.

Monetization

It’s time to take your pricing seriously. Consider optimizing your plans (for realsies this time) to create no-brainer scenarios for customers who need more value from the product.

Create cross-sell and up-sell opportunities. Much of this depends on your rigor regarding product management and development, of course.

Retention

Pause the product projects that don’t directly retain more customers. It’s usually easier and cheaper to keep an existing customer than focus exclusively on acquiring net new customers.

Introduce dunning and reactivation practices (like payment recovery campaigns, pre-dunning, salvage offers, maintenance plans, reactivation campaigns after 180 days, etc.).

My advice: The time to invest in growth is now

Time will most certainly reveal whatever the American market is doing well after the fact and likely with much debate.

But in the meantime, my recommendation is that founders and growth teams focus on sustainable means of growth. For PLG companies, that will forever and always be the list above: qualified acquisition, effective activation, monetization, and long-term retention strategies.

If you’ve got bigger budgets to spend on marketing and growth, it makes sense to focus on making strategic bets about where those funds are going. I’ve seen enterprise and growth-stage PLG SaaS companies ($50M - $500M ARR) re-evaluate investments in paid acquisition, activation, and even monetization for specific segments and cohorts of customers since not all are going to be as profitable or effective long-term.

Budgets then get re-allocated to customer segments and growth projects that the org believes will pay out after the shake-down is done and economic growth returns.

If you’ve got smaller budgets to spend on marketing and growth, then you’ll need to find growth levers to pull that don’t require spending tons of cash on acquiring new customers. Think like finding new product opportunities to invest in, finally investing in re-doing your pricing, overhauling activation if you’ve got poor net new user retention rates, and focusing on your most profitable customer segments.

Remember: the best drivers of a recession race track hit the brakes (cut costs), turn towards the apex (adjust strategy), and go ham before the other drivers can catch up.

So, where’s your line? 🏎️✨

Need help with identifying your most sustainable growth opportunities?

That’s something we can help with! In just 45 minutes, we can identify the top areas of opportunity to explore — whether that’s acquisition, activation, monetization, and/or long-term retention strategies — for free.

Source: https://www.axios.com/2024/05/23/us-recession-economic-data-poll

Source: https://www.bain.com/contentassets/f97a479571d04408ab8c8d20f150d6ca/bain_brief_beyond_the_downturn_recession_strategies_to_take_the_lead.pdf

Source: https://hbr.org/2010/03/roaring-out-of-recession